In many cases only a portion of the roofing system is replaced and depending on the facts those costs may be deducted as repairs.

Roof life depreciation.

Improvements are depreciated using the straight line method which means that you must deduct the same amount every year over the useful life of the roof.

For example installing all new hvac units may require additional roof penetrations and changes to the roof covering.

Are generally depreciated over a recovery period of 27 5 years using the straight line method of depreciation and a mid month convention as residential rental property.

Like any piece of working capital your roof will slowly degrade over time as it fulfills its purpose which in this case is to protect your building from the elements.

Each year tax professionals who deal with real estate must evaluate the most recent building expenditures and determine which items should be written off as a repair expense or capitalized.

Let s say your roof is supposed to last 20 years and it s 5 years old when damaged.

For example if you ve owned a rental property for 10 years before you installed a new roof you can depreciate the roof over 27 5 years even though you have 17 years of depreciation left on the property.

See which forms to use in chapter 3.

Calculating depreciation begins with two factors.

The replacement cost of the roof and the expected lifetime of the roof for example the average cost to replace a roof is 10 000 and asphalt roofs generally have a lifespan of 15 years.

For example if the new roof costs 15 000 divide that figure by 27 5.

Cedar is the preferred choice for wood shingles also called shakes because it s rot and insect resistant.

You can deduct depreciation only on the part of your property used for rental purposes.

You may have to use form 4562 to figure and report your depreciation.

The most common and often significant item that is evaluated is roofing related work.

How is depreciation on a roof calculated.

Wind rain sunshine snow and falling debris can all help to shorten the lifespan of your roof.

Calculating depreciation based on age is straightforward.

Your roof s lifespan may vary depending on what kind you have whether it is an asphalt pvc tile or metal roof.

If the scope of any other capital improvement project required the roof work the roofing costs would be depreciated along with the capital project.

Repainting the exterior of your residential rental property.

Depreciation reduces your basis for figuring gain or loss on a later sale or exchange.

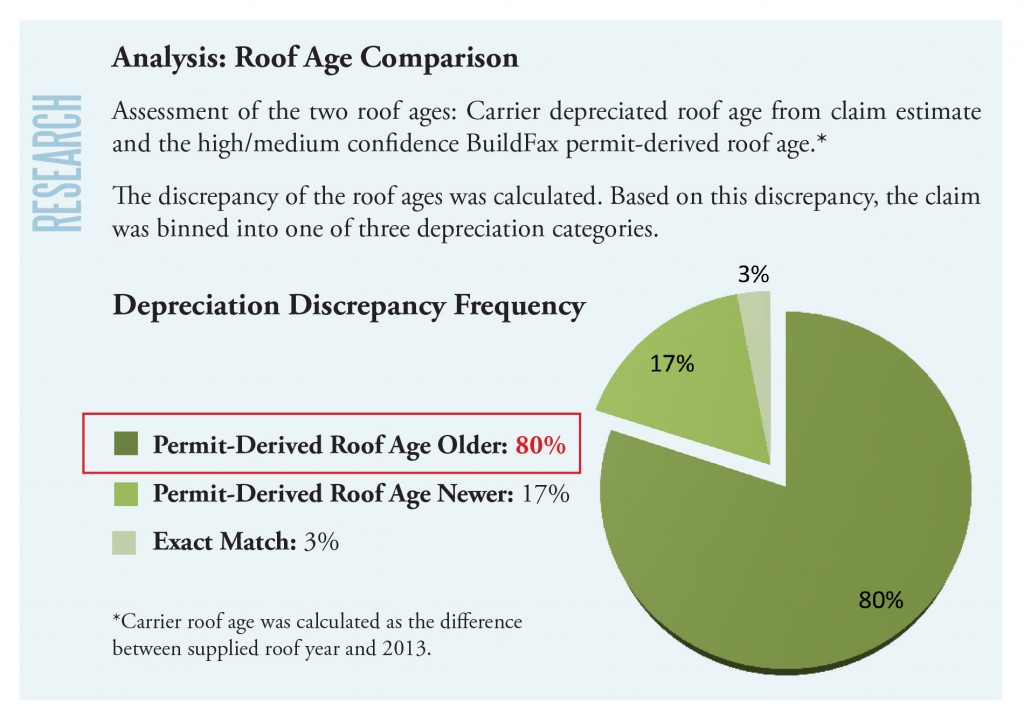

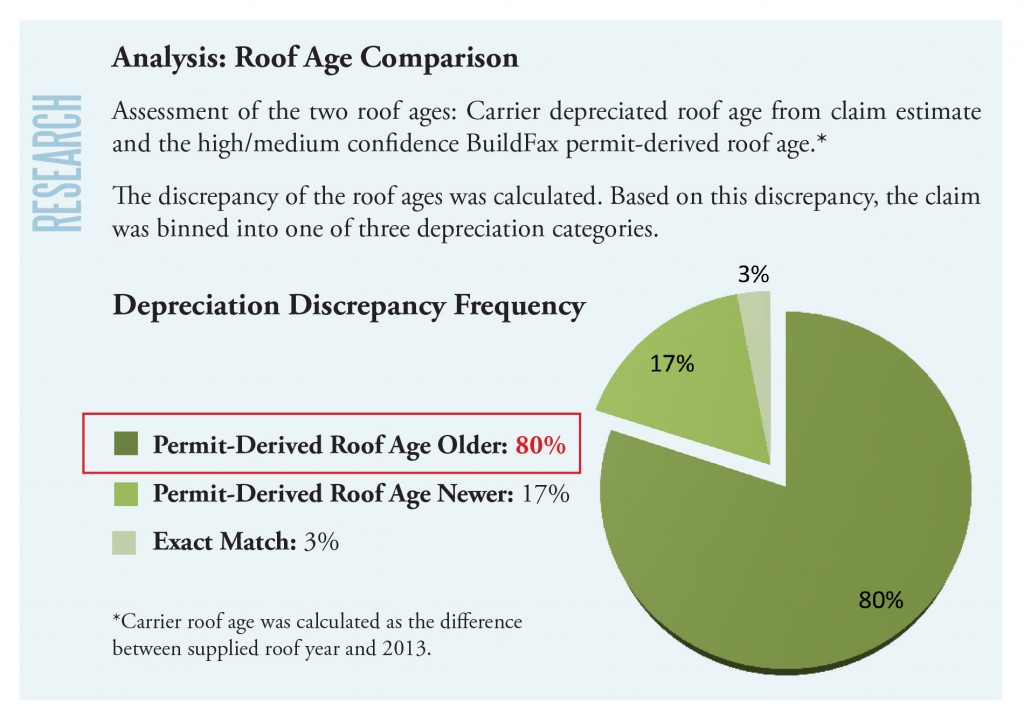

When a claims adjuster looks at a roof he will consider the condition of the roof as well as its age.

What is the depreciation of the roof on a commercial building.

The roof depreciates in value 5 for every year or 25 in this case.